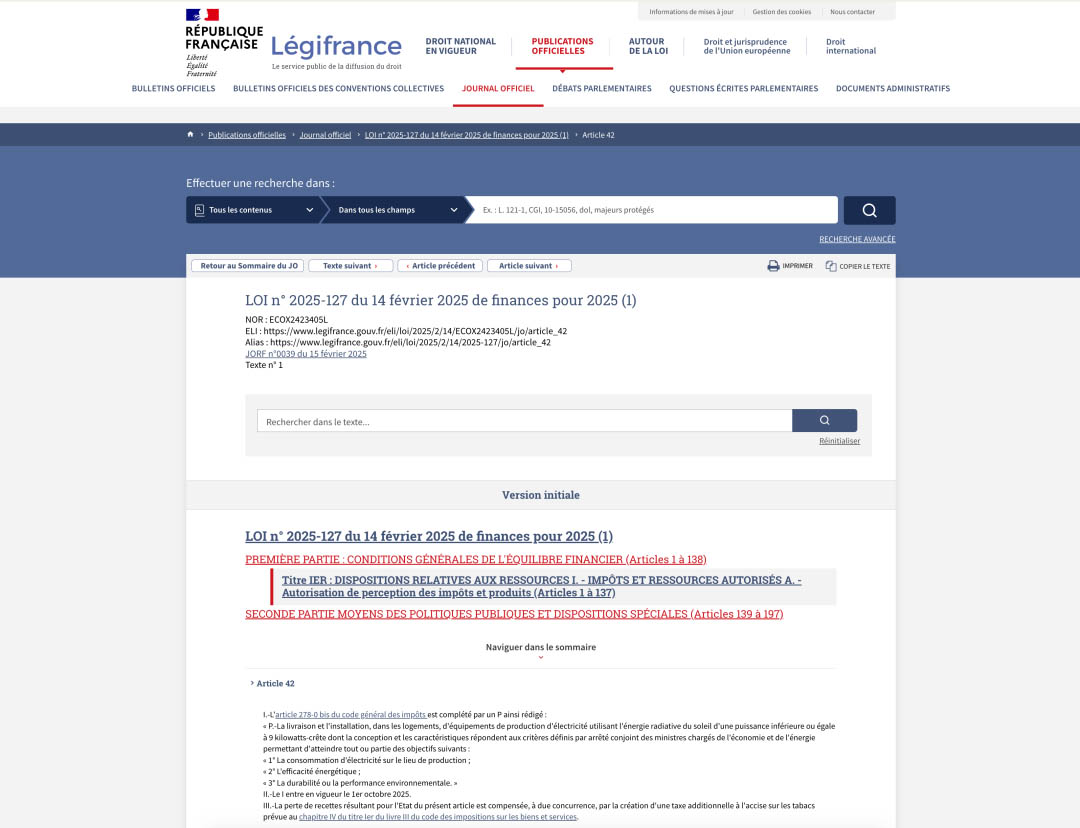

Kusukela mhla lu-1 kuMfumfu 2025, iFrance ihlela ukusebenzisa izinga le-VAT elincishisiwe elingu-5.5% ku-izinhlelo zamaphaneli elanga zokuhlalaenomthamo ongaphansi kuka-9kW. Lokhu kusho ukuthi imindeni eminingi ingafaka ugesi welanga ngezindleko eziphansi. Lokhu kwehliswa kwentela kwenziwa ukuthi kwenzeke yizinyathelo ze-EU zokukhululeka kwezinga le-VAT zika-2025, ezivumela amazwe angamalungu ukuthi asebenzise amazinga ancishisiwe noma awekho ezintweni zokonga amandla ukuze kukhuthazwe ukutshalwa kwezimali okuluhlaza.

1. Izidingo Zenqubomgomo Yelanga

Imininingwane yokusetshenziswa ayikakakhishwa ngokusemthethweni okwamanje. Ulwazi olulandelayo lusesesigabeni sokubhalwa futhi kulindeleke ukuthi luthunyelwe kwi-High Energy Council yaseFrance ukuze lubuyekezwe ngoSepthemba 4, 2025.

>> Izidingo Zokuhlela Zamaphaneli Elanga Afanelekela I-VAT Encishisiwe

Ukuze ufanelekele lokhu kwehliswa kwe-VAT okungangcolisi imvelo, amaphaneli elanga kumele ahlangabezane nezindinganiso eziqinile zokukhiqiza, hhayi nje izilinganiso zokusebenza. Izidingo ezithile zifaka:

- ⭐ I-Carbon Footprint:Ngaphansi kuka-530 kgCO₂ eq/kW

- ⭐Okuqukethwe kwesiliva: Ngaphansi kuka-14 mg/W.

- ⭐Okuqukethwe Okuholayo:Ngaphansi kuka-0.1%

- ⭐Okuqukethwe kwe-Cadmium:Ngaphansi kuka-0.01%

Lezi zindinganiso zihlose ukuqondisa imakethe kumamojula elanga anokukhishwa kwekhabhoni okuphansi kanye nokuqukethwe kwensimbi enobuthi okuncishisiwe, okukhuthaza ukusimama kwemvelo.

>> Izidingo Zesitifiketi Sokuthobela Imithetho

Izinhlangano zezitifiketi kumele zinikeze izitifiketi zokuthobela imithetho yamamojula. Imibhalo kumele ihlanganise:

- ⭐ Ukulandelela izindawo zokukhiqiza zamamojula, amaseli ebhethri, nama-wafer.

- ⭐ Ubufakazi bokuhlolwa kwemboni okwenziwe ezinyangeni eziyi-12 ezedlule.

- ⭐ Imiphumela yokuhlola izinkomba ezine ezibalulekile zemojuli (i-carbon footprint, isiliva, i-lead, i-cadmium).

Isitifiketi sisebenza unyaka owodwa, siqinisekisa ukubhekwa njalo kanye nokulawulwa kwekhwalithi.

2. Amanye amazwe aseYurophu nawo aqalise izikhuthazo ze-VAT

IFrance akuyona yodwa izwe elisebenzisa ukwehliswa kwe-VATi-PV yelangaNgokusho kolwazi olutholakala emphakathini, amanye amazwe aseYurophu nawo asebenzise izinyathelo ezifanayo.

| Izwe | Isikhathi Senqubomgomo | Imininingwane Yenqubomgomo |

| IJalimane | Kusukela ngoJanuwari 2023 | Izinga le-VAT elingenalutho lifakiwe ku-izinhlelo ze-PV zelanga zokuhlala(≤30 kW). |

| I-Austria | Kusukela ngoJanuwari 1, 2024 kuya kuMashi 31, 2025 | Izinga le-VAT eliyi-zero lisetshenziswa ezinhlelweni ze-PV zelanga zokuhlala (≤35 kW). |

| IBelgium | Phakathi kuka-2022-2023 | Izinga le-VAT elincishisiwe elingu-6% (kusukela ku-21%) ejwayelekile lokufaka izinhlelo ze-PV, amaphampu okushisa, njll., ezakhiweni zokuhlala ezineminyaka engu-≤10 ubudala. |

| iNetherlands | Kusukela ngoJanuwari 1, 2023 | Izinga le-VAT eliyi-zero kumaphaneli elanga ezindlu kanye nokufakwa kwawo, futhi futhi alikhokhiswa i-VAT ngesikhathi sokukhokha kwe-net metering. |

| UK | Kusukela mhla lu-1 kuMbasa 2022 kuya kumhla zingama-31 kuNdasa 2027 | Izinga le-VAT eliyi-zero ezintweni ezonga amandla okuhlanganisa amaphaneli elanga, indawo yokugcina amandla, kanye namaphampu okushisa (okusebenza ezindaweni zokuhlala). |

Hlala unolwazi mayelana nezibuyekezo zakamuva embonini yokugcina amandla elanga!

Ukuze uthole izindaba ezengeziwe kanye nokuqonda, sivakashele ku:https://www.youth-power.net/news/

Isikhathi sokuthunyelwe: Septhemba 17-2025