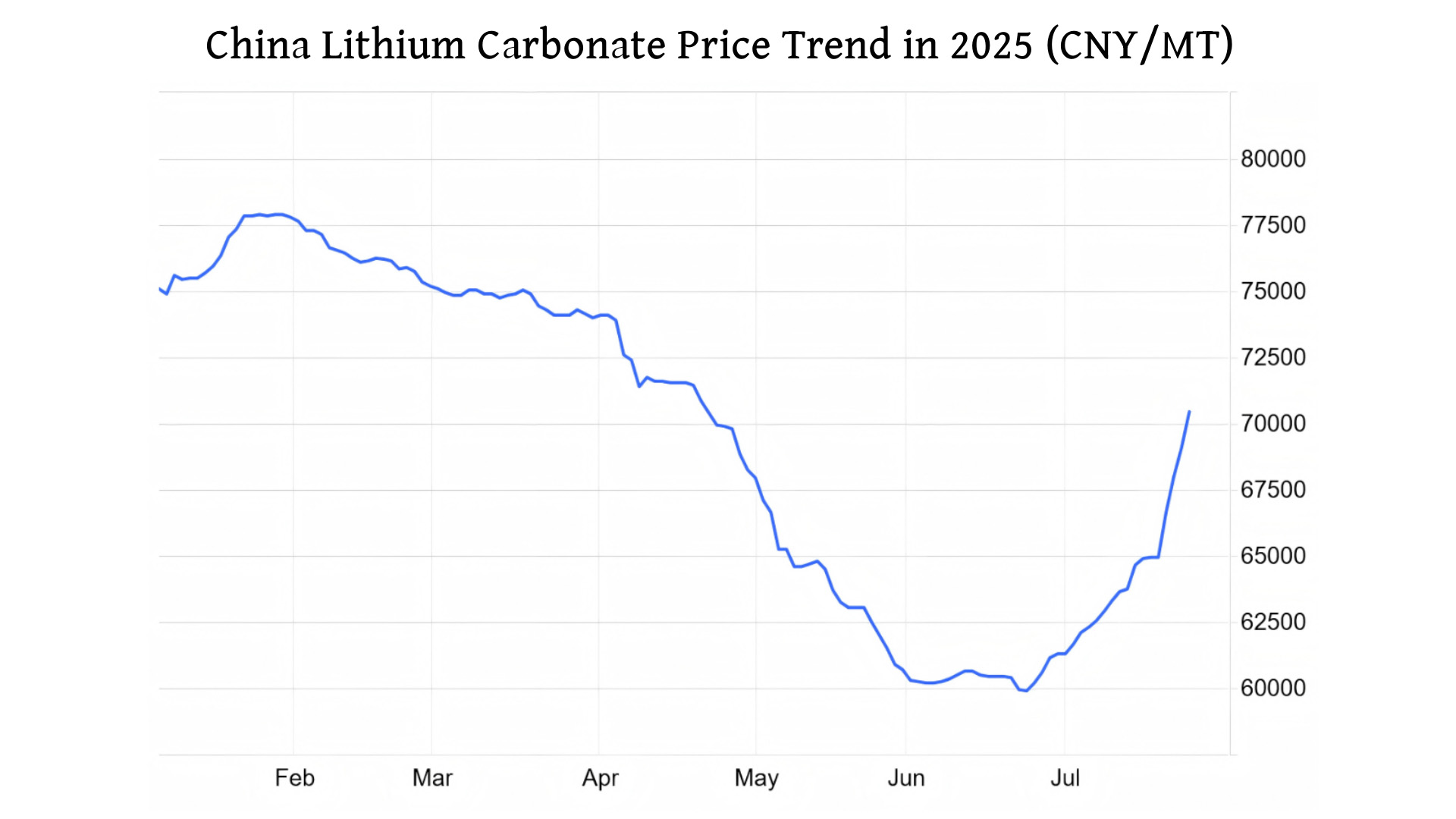

Lithium carbonate prices have experienced a significant surge, jumping over 20% to reach 72,900 CNY per ton over the past month. This sharp increase follows a period of relative stability earlier in 2025 and a notable dip below 60,000 CNY per ton just weeks ago. Analysts attribute this rapid price rebound primarily to new government industrial policies aimed at restructuring key sectors like metals and energy, as well as improving demand fundamentals within the clean energy sector.

1. What's Driving the Lithium Price Spike

The catalyst appears to be China's new industrial policy direction, focusing on structural adjustments and reducing outdated production capacity across major industries. This policy signal ignited a broader rally in commodity markets, including coal, steel, and glass. For lithium carbonate specifically, the price jump reflects a combination of constrained supply, policy tailwinds, and gradually strengthening demand, particularly as the domestic new energy industry consolidates. International factors also play a role, with European EV demand recovering and Southeast Asian markets continuing their rapid expansion, underpinning lithium consumption.

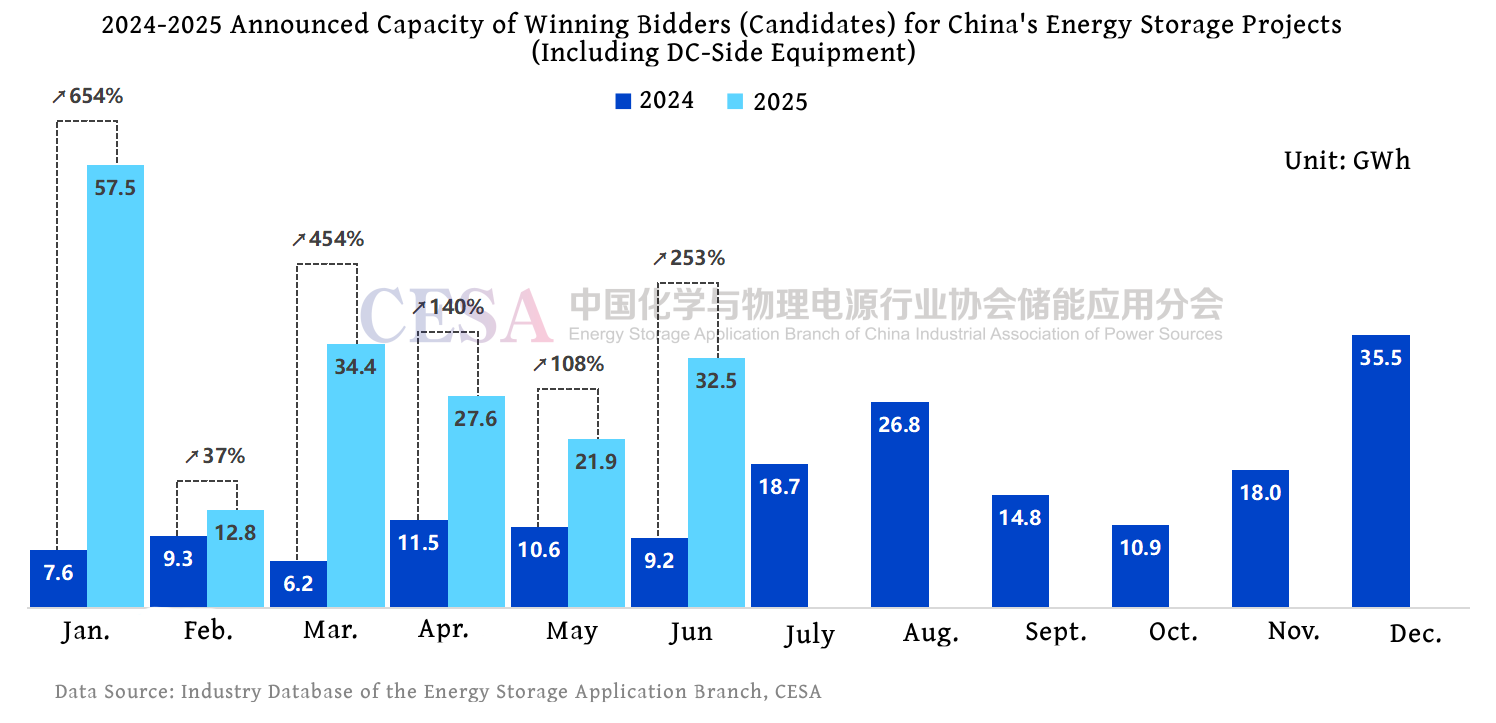

2. Why is Energy Storage Demand Exploding

The solar energy storage sector is experiencing unprecedented growth both domestically and internationally. Data shows that Chinese companies secured overseas energy storage orders exceeding 160 GWh in just the first half of 2025 – a staggering 220% year-on-year increase. During the same period, China energy storage procurement increased by 243% to reach 46.1GW/186.7GWh. This significant surge in demand for lithium energy storage battery cells is directly translating upstream into higher raw material costs.

3. How Will This Impact the Battery Industry?

The lithium price surge is already rippling through the supply chain. Major system integrators report receiving price hike notifications from energy storage battery cell manufacturers, with increases estimated at 10% or more. Battery cell availability is tightening significantly, with even second-tier brands facing potential shortages. While this signals rising costs for batteries in the near term, industry experts view it as a necessary market correction during the sector's shift from pure volume expansion towards value-driven growth. Crucially, this is not expected to mirror the extreme price spikes seen in 2022. Furthermore, this development offers a crucial, extended opportunity for alternative technologies like sodium-ion batteries to gain market traction.

This lithium carbonate rally underscores the ongoing volatility in battery materials markets, driven by policy shifts and surging global demand for electrification and energy storage solutions. While near-term cost pressures are real, the industry views this as part of a necessary maturation phase.

Post time: Jul-29-2025